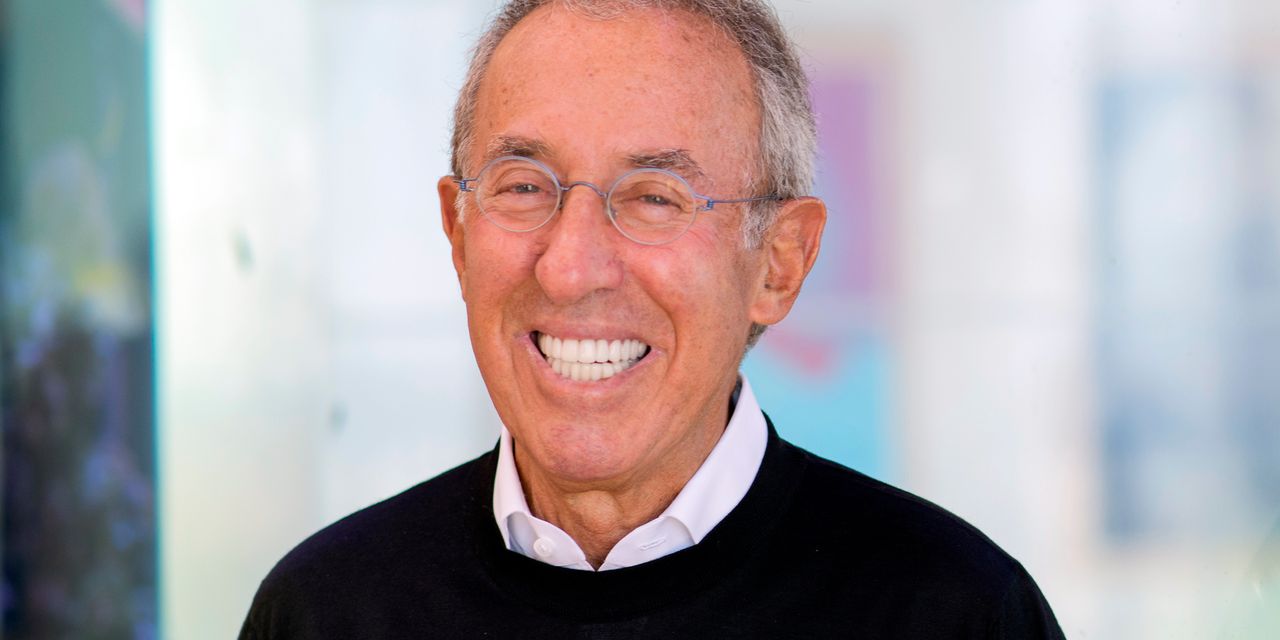

The Future Realized

Innovation is the implementation of something new—a positive change in what has been established by introducing new ideas. At Innovation X Advisors, our strategy is to identify investment opportunities in privately held companies that possess innovative or disruptive technologies. These transformative companies are solving meaningful problems and changing the world we live in.

Portfolio Exits

Innovation X Advisors strives to deliver access to the largest and most innovative private companies. Returns from investing in these late-stage companies continue to outperform public markets as well as other asset classes. View our impressive portfolio and see how we are committed to maximizing returns for our members.

Source: Cambridge Associates and Venture Capital Index Funds

Source: Pitchbook

Source: PREQIN

Source: Innovation X Advisors

Innovation X Advisors is founded in the belief that late-stage investing has the opportunity to be inherently less risky, thus maximizing the returns for investors.

Innovation X Advisors typically targets companies with a market cap of at least $3 billion and that have been operating for more than five years. By investing in these late-stage companies, our members can optimize their returns and reduce their market risk. How? Because late-stage investments shorten the investment-time horizon while potentially capturing the period of strongest value growth. Compared to traditional venture capital returns, secondary market returns have a higher performance rate by giving members the chance to buy at discounts to primary rounds, acting as a liquidity provider to forced sellers.